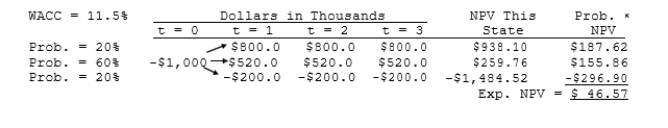

Aggarwal Enterprises is considering a new project that has a cost of $1,000,000, and the CFO set up the following simple decision tree to show its three most likely scenarios. The firm could arrange with its work force and suppliers to cease operations at the end of Year 1 should it choose to do so, but to obtain this abandonment option, it would have to make a payment to those parties. How much is the option to abandon worth to the firm?

A) $55.08

B) $57.98

C) $61.03

D) $64.08

E) $67.29

Correct Answer:

Verified

Q42: Which one of the following would NOT

Q53: Which of the following statements is CORRECT?

A)

Q58: Langston Labs has an overall (composite) WACC

Q59: As a member of UA Corporation's financial

Q61: Desai Industries is analyzing an average-risk project,

Q62: Liberty Services is now at the end

Q63: Poulsen Industries is analyzing an average-risk project,

Q65: Florida Car Wash is considering a new

Q66: Foley Systems is considering a new investment

Q67: Thomson Media is considering some new equipment

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents