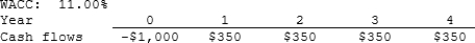

Tuttle Enterprises is considering a project that has the following cash flow and WACC data. What is the project's NPV? Note that if a project's expected NPV is negative, it should be rejected.

A) $77.49

B) $81.56

C) $85.86

D) $90.15

E) $94.66

Correct Answer:

Verified

Q66: Project X's IRR is 19% and Project

Q70: Which of the following statements is CORRECT?

Q75: You are on the staff of Camden

Q78: A company is choosing between two projects.

Q79: Projects A and B are mutually exclusive

Q80: Warr Company is considering a project that

Q81: Sexton Inc. is considering Projects S and

Q82: Simkins Renovations Inc. is considering a project

Q83: Last month, Lloyd's Systems analyzed the project

Q84: Maxwell Feed & Seed is considering a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents