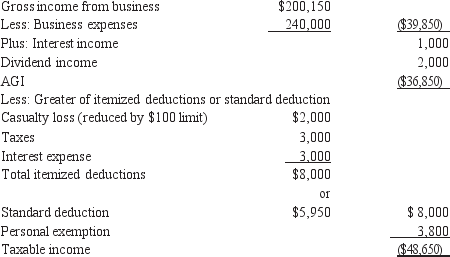

During 2012, John Colburn, a single individual, reports the following taxable income:

Compute John Colburn's net operating loss for 2012.

Compute John Colburn's net operating loss for 2012.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q41: Which of the following is not deductible?

A)

Q42: Tammy has the following items for the

Q43: Which of the following is not a

Q44: On December 28, 2012, Alan Davis died

Q45: During 2012, Tommy's home was burglarized. Tommy

Q47: Mike, who is single, has $100,000 of

Q48: Net operating losses can be increased by

Q49: Bob Mapp gave his daughter a limited

Q50: Which of the following statements is correct?

A)

Q51: Jim owns four separate activities. He elects

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents