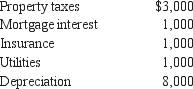

In the current year, Sam Lett purchased a condominium in Hilton Head Island, South Carolina. Sam and his family used the condominium for a total of 30 days. fte condominium was rented out a total of 70 days during the year, generating $9,000 of rental income. Sam incurred the following expenses:

(a.) Determine Sam's deductible expenses using the IRS approach.

(a.) Determine Sam's deductible expenses using the IRS approach.

(b.) How much depreciation can be deducted in the current year if the rental income was $12,000? (c.) Does Sam have any options with regard to the interest and taxes?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q60: Fred's at-risk amount in a passive activity

Q61: In the current year, Bob Colburn's accounting

Q62: Katelyn Jones owned interests in five limited

Q63: John Baron, a professional baseball player, raises

Q64: Two taxpayers, Bob Ames and Alice Brown,

Q66: Virgil Watson gave his daughter, Holly, a

Q67: During the current year, Jack Goodwin, a

Q68: John Henry was a partner in a

Q69: Jan Ellis has gross income of $140,000

Q70: You own a building that you constructed

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents