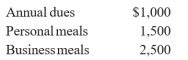

A self-employed attorney uses a country club to entertain clients and spends the following amounts at the club:  What amount can the attorney deduct against business income on his personal tax return?

What amount can the attorney deduct against business income on his personal tax return?

A) $0

B) $1,250

C) $1,750

D) $2,250

E) $2,500

Correct Answer:

Verified

Q95: A calendar-year corporation incurs $53,000 of start-up

Q96: During the holiday season, a taxpayer gives

Q97: Two years ago, a corporation purchased residential

Q98: fte two types of depletion methods are:

A)

Q99: fte process used to recover the cost

Q101: Five-year property costing $25,000 was placed in

Q102: Jim Bender incurs the following moving expenses:

Q103: Are any of the following items deductible

Q104: Which of the following are capital expenditures

Q105: During 2012, Klecker, Inc. placed in service

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents