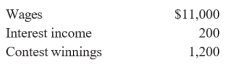

Douglas Druper is single and was unemployed from August through November 2012. During this time, he received $2,000 in unemployment compensation. Douglas also received the following income during 2012:  Douglas did not have any adjustments to income for 2012. How much, if any, of the unemployment compensation should Douglas include in gross income?

Douglas did not have any adjustments to income for 2012. How much, if any, of the unemployment compensation should Douglas include in gross income?

A) $0

B) $500

C) $1,100

D) $1,200

E) $2,000

Correct Answer:

Verified

Q25: The following information is available for Ann

Q26: During the current year, Alfred Allen sustained

Q27: Frank Clarke, an employee of Smithson Company,

Q28: Which of the following items should be

Q29: Randi, a flight attendant, received wages of

Q31: Rachel Reeves has medical insurance coverage from

Q32: Victor and Claire Anet, residents of a

Q33: With regard to tax recognition of alimony

Q34: Marnie purchased a bond on August 15,

Q35: Ms. Green is single and over 65

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents