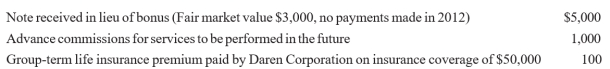

Todd is a cash-basis taxpayer. Daren Corporation made the following payments to or on behalf of Todd during 2012.  What amount should Todd report as income in 2012?

What amount should Todd report as income in 2012?

A) $6,100

B) $5,100

C) $4,100

D) $4,000

Correct Answer:

Verified

Q39: During 2012, Anne Apple received tangible personal

Q40: During 2012, Edward East had wages of

Q41: Mr. and Mrs. Clark are both 72

Q42: During 2012, under a qualified written plan

Q43: Sherwood received disability income of $6,000 for

Q45: Cyril, who is 68 years of age,

Q46: Sandra Bellows purchased a 15-year annuity for

Q47: Henry Adams, an unmarried taxpayer, received the

Q48: Linda Smith paid $25,000 in premiums on

Q49: All of the following would be excluded

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents