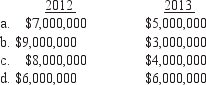

In 2012, Zog Company enters into a two-year contract to construct a building for $40,000,000. Zog Company estimates it will cost $30,000,000 to complete the building. It completed the building in 2013, and actual costs were $21,000,000 in 2012 and $7,000,000 in 2013. What gross profit does Zog Company report in 2012 and 2013?

Correct Answer:

Verified

Q61: Gregory McDonald sold a piece of land

Q62: John sold a painting on November

Q63: Failure to make a timely accounting election

Q64: Sunel Corporation uses the FIFO method of

Q65: Barrack sold stock on November 6, 2012

Q67: Sarah sold land on November 8, 2012

Q68: Christman Co. adopts the simplified dollar-value LIFO

Q69: Hillary Co. is a cash basis taxpayer.

Q70: Wonderworks Corporation sells and repairs equipment. Wonderworks

Q71: Sandra Surrey sold her racehorse for $40,000

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents