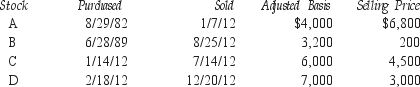

For 2012, Steven Sutton had taxable income of $40,000. His stock transactions in 2012 were as follows:  What is Steve's net capital loss for 2012 and his carryover to 2013?

What is Steve's net capital loss for 2012 and his carryover to 2013?

A) Deduction: $3,000; carryover: $2,700

B) Deduction: $3,000; carryover: $3,000

C) Deduction: $5,700; carryover: $3,000

D) Deduction: $5,700; carryover: $2,700

Correct Answer:

Verified

Q37: In making a charitable transfer of Section

Q38: If business casualty gains exceed business casualty

Q39: fte recapture rules under Section 1245 depend

Q40: Although the recapture provisions of Sections 1245

Q41: Ralph Robinson has a long-term capital loss

Q43: Individuals are entitled to a 50% capital

Q44: Gain on the sale of 19-year real

Q45: Capital gains and losses generally do not

Q46: A real estate dealer who holds property

Q47: Oscar Orsen is an officer of Atlas

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents