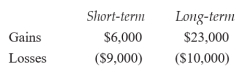

Mike Mitchell had the following capital transaction during the current tax year:  What portion of Mike's capital gains is included in his adjusted gross income?

What portion of Mike's capital gains is included in his adjusted gross income?

A) $2,000

B) $3,000

C) $4,000

D) $5,000

E) $10,000

Correct Answer:

Verified

Q77: On January 4, 1980, Rita Racksaw purchased

Q78: All of the following assets are Section

Q79: Susan Songbird sold a word processor used

Q80: For 2012, Joyce Jacobson's books and records

Q81: Complete the blanks in the following sentence.

Q83: A calendar-year taxpayer had net Code Sec.

Q84: A gain on the disposition of Section

Q85: During 2012, Randy Rooney recognizes a $13,000

Q86: If a taxpayer had elected to expense,

Q87: During 2012, Norman Newhouse sold equipment used

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents