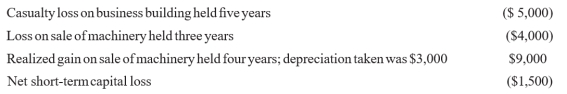

Linda Larsen, single, had the following items during 2012:  Linda had adjusted gross income of $45,000 and $6,000 itemized deductions without the above items.

Linda had adjusted gross income of $45,000 and $6,000 itemized deductions without the above items.

(a.) What is Linda's taxable income for 2012?

(b.) Assuming the same facts as given above except that Linda had a casualty gain of $2,000 on the business building held five years rather than a casualty loss of $5,000, what is Linda's taxable income for 2012?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q96: Land used in the taxpayer's business is

Q97: During 2012, Judy Jenkins sold Section 1250

Q98: Which of the following properties is not

Q99: Tony Tinker, single, sells 3,000 shares of

Q100: Net capital gain is defined as:

A) the

Q102: On January 1, 1986, Joyce Jillian purchased

Q103: Nancy Newly died on February 16, 2012,

Q104: Jack Jones has the following casualty gains

Q105: On January 1, 2011, Patrick Polk purchased

Q106: Kendall Knox has a machine (Section 1245

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents