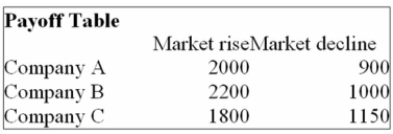

You are trying to decide in which of the three companies you should invest. Refer to the following

Payoff Table.

If the probability of the market declining in the next year is 0.5, which of the following statements

Are correct?

i. The Expected value of stock purchased under conditions of certainty is $1,675.

ii. The Expected value of stock purchased under conditions of certainty is $2,200.

iii. The Expected value of stock purchased under conditions of certainty is $1,150.

A) (i) , (ii) , and (iii) are all correct statements.

B) (i) is a correct statement but not (ii) or (iii) .

C) (ii) is a correct statement but not (i) or (iii) .

D) (iii) is a correct statement but not (i) or (ii) .

E) (i) , (ii) , and (iii) are all false statements.

Correct Answer:

Verified

Q32: You are trying to decide in which

Q32: The maximin strategy:

A) minimizes the maximum gain.

B)

Q33: You are trying to decide in which

Q34: i. EVPI = Expected value under conditions

Q35: Given the following decision table in which

Q36: You are trying to decide in which

Q39: You are trying to decide in which

Q40: For the below payoff table, if P(S1)

Q41: Determine the expected value for the following

Q42: You have a decision to invest $10,000

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents