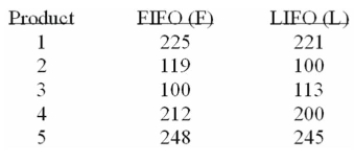

Accounting procedures allow a business to evaluate their inventory at LIFO (Last In First Out) or

FIFO (First In First Out) . A manufacturer evaluated its finished goods inventory (in $1000) for five

Products both ways. Based on the following results, is LIFO more effective in keeping the value of

His inventory lower?

If you use the 5% level of significance, what is the critical t value?

A) +2.571

B) ±2.776

C) +2.262

D) ±2.228

E) +2.132

Correct Answer:

Verified

Q40: When is it appropriate to use the

Q64: Accounting procedures allow a business to evaluate

Q65: Accounting procedures allow a business to evaluate

Q66: A local retail business wishes to determine

Q67: Accounting procedures allow a business to evaluate

Q68: A poll of 400 people from village

Q71: Accounting procedures allow a business to evaluate

Q72: A random sample of 20 statistics students

Q73: Accounting procedures allow a business to evaluate

Q74: A random sample of 20 statistics students

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents