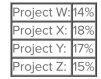

On-line Text plc has four new text publishing products that it must decide on publishing to expand its services. The firm's WACC has been . The projects are of equal risk, Bs of . The risk-free rate is and the market rate is expected to be . The projects are expected to earn as follows:

What projects should be selected and why?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q38: Peter's Audio Shop has a cost of

Q39: A firm with high operating leverage is

Q40: A firm with high operating leverage has:

A)low

Q42: Neptune plc offers network communications systems to

Q43: rate for capital budgeting purposes. However,

Q44: Given the sample of returns of Top

Q44: Explain the factors that determine beta and

Q46: Given the sample of returns of Top

Q47: NuPress Valet has an improved version of

Q48: The Template Corporation has an equity beta

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents