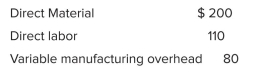

White Water Rafting Company manufactures kayaks, which sell for $565 each.The variable costs of production (per unit) are as follows:  Budgeted fixed overhead in 20x1 was $400,000 and budgeted production was 50,000 kayaks.The year's actual production was 50,000 units, of which 47,000 were sold.Variable selling and administrative costs were $5 per unit sold; fixed selling and administrative costs were $75,000. Required: 1.Calculate the product cost per kayak under (a) absorption costing and (b) variable costing. 2.Prepare operating income statements for the year using (a) absorption costing and (b) variable costing. 3.Reconcile reported operating income under the two methods using the shortcut method.

Budgeted fixed overhead in 20x1 was $400,000 and budgeted production was 50,000 kayaks.The year's actual production was 50,000 units, of which 47,000 were sold.Variable selling and administrative costs were $5 per unit sold; fixed selling and administrative costs were $75,000. Required: 1.Calculate the product cost per kayak under (a) absorption costing and (b) variable costing. 2.Prepare operating income statements for the year using (a) absorption costing and (b) variable costing. 3.Reconcile reported operating income under the two methods using the shortcut method.

Correct Answer:

Verified

Q26: Income reported under absorption costing and variable

Q52: Which of the following situations would cause

Q64: What is a product's grade, as a

Q71: What is the difference between a product's

Q80: Assuming the number of units sold and

Q81: What are three strategies of environmental cost

Q82: What is the difference between observable and

Q83: Xenon Enterprises (XE) produces two extruding machines

Q84: List and define four types of product

Q87: Required: Prepare a quality-cost report.

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents