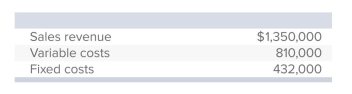

Samuels, Inc.is subject to a 40% income tax rate.The following data pertain to the period just ended when the company produced and sold 45,000 units:  How many units must Samuels sell to earn an after-tax profit of $180,000?

How many units must Samuels sell to earn an after-tax profit of $180,000?

A) 42,000.

B) 45,000.

C) 51,000.

D) 61,000.

E) None of the answers is correct.

Correct Answer:

Verified

Q105: Exercise Express sells exercise equipment.For purposes of

Q106: Edmonco Company produced and sold 45,000 units

Q107: A company, subject to a 40% tax

Q108: Calle Company is studying the impact of

Q109: Falcon Environmental Services, Inc.provides consulting services to

Q111: When advanced manufacturing systems are installed, what

Q112: Techtron, Inc.has a fixed cost of $225,000

Q113: Which of the following calculations can be

Q114: On Time Products produced and sold digital

Q115: You are analyzing Barroz Corporation and Newton

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents