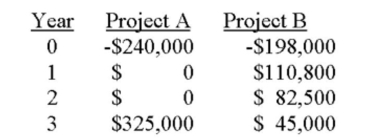

You are considering two mutually exclusive projects with the following cash flows. Will your choice

between the two projects differ if the required rate of return is 8 percent rather than 11 percent? If

so, what should you do?

A) Yes; Select A at 8 percent and B at 11 percent.

B) Yes; Select B at 8 percent and A at 11 percent.

C) Yes; Select A at 8 percent and select neither at 11 percent.

D) No; Regardless of the required rate, project A always has the higher NPV.

E) No; Regardless of the required rate, project B always has the higher NPV.

Correct Answer:

Verified

Q375: The internal rate of return:

A) Is the

Q376: An investment has the following cash flows.

Q377: According to the capital budgeting surveys cited

Q378: A conventional cash flow is defined as

Q379: You are considering an investment with the

Q381: You are to present a proposed capital

Q382: Without using formulas, provide a definition of

Q382: Would you accept a project which is

Q383: Given that the net present value (NPV)

Q384: Without using formulas, provide a definition of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents