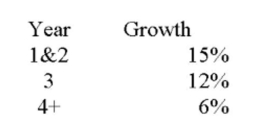

Moore Money Inc. just paid a dividend of $2. The required return on the stock is 15%. If it has the following expected dividend growth rates what should the stock sell for?

A) $22.45

B) $26.17

C) $27.79

D) $28.89

E) $29.68

Correct Answer:

Verified

Q141: Gen-Y corporation's current stock price is $50

Q145: XYZ Corporation's next dividend is expected to

Q156: Berkshire Homes recently paid $2.20 as an

Q157: Jim owns shares of Abco, Inc. preferred

Q159: Sedge Inc. has a 12% required rate

Q162: Home Builders, Inc. is a very cyclical

Q163: If a company has a current stock

Q163: Nu Electronics is expecting a period of

Q164: Master Technicians just announced that it is

Q164: ABC Corporation has just paid a $4

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents