Multiple Choice

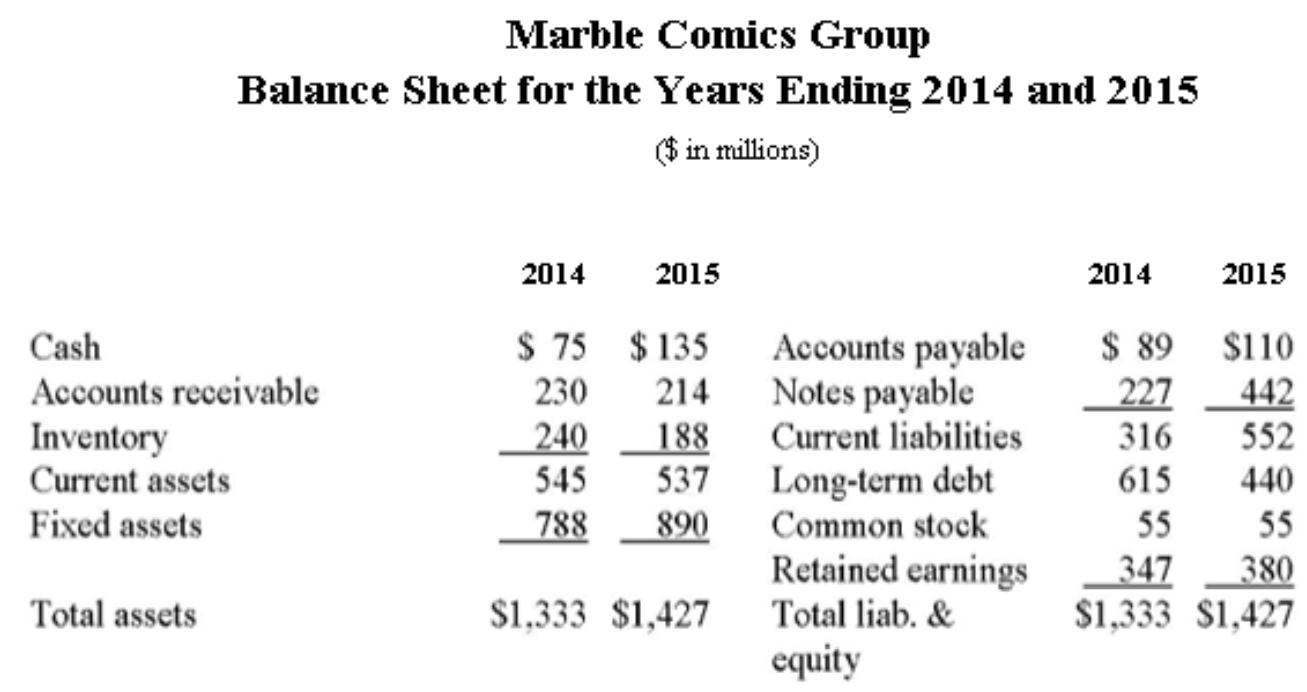

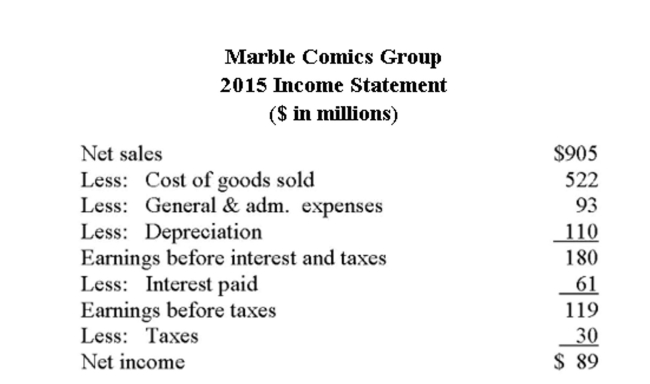

Assume Marble is projecting a 20% increase in sales for the coming year, with current assets, all costs, and current liabilities proportional to sales. Long-term debt is not proportional to sales. If the

Assume Marble is projecting a 20% increase in sales for the coming year, with current assets, all costs, and current liabilities proportional to sales. Long-term debt is not proportional to sales. If the

firm's tax rate remains unchanged, the dividend payout is 40%, and Marble is operating at 70% of

Capacity, what is the external financing needed (EFN) for 2015 ($ in millions) ?

A) EFN is negative

B) $21.94

C) $48.31

Correct Answer:

Verified

Related Questions

Q113: Calculate the external financing needed given the

Q114: Q115: A firm currently has sales of $550,000, Q116: Calculate the projected fixed assets needed given![]()