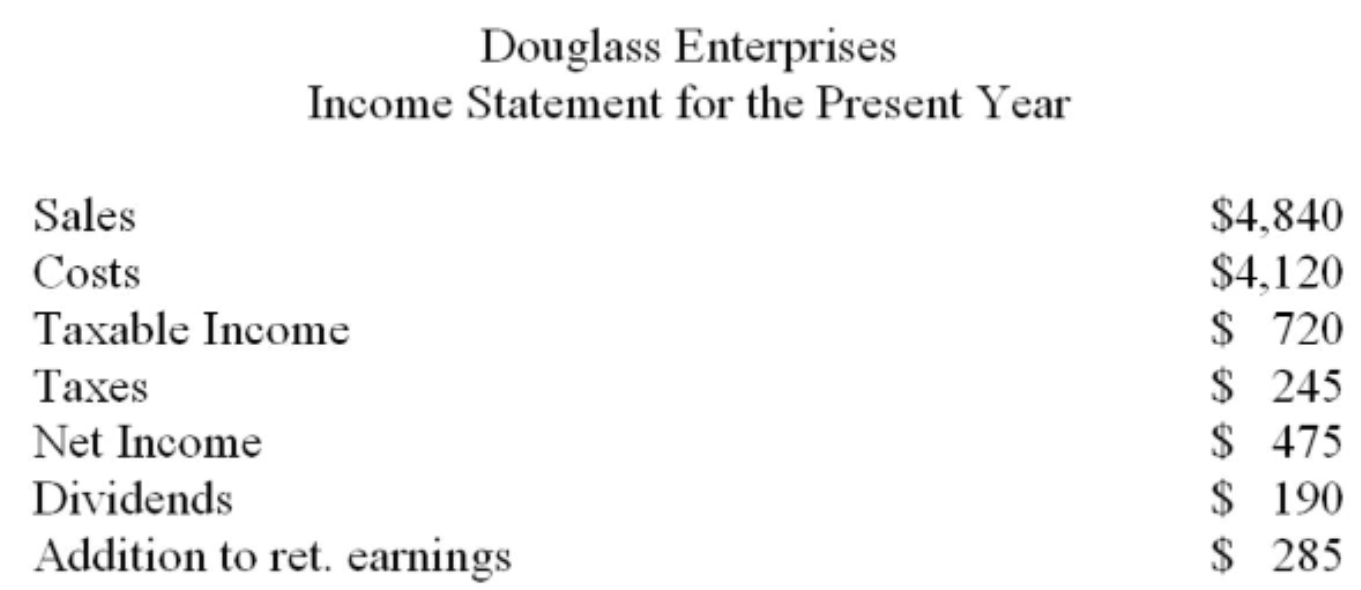

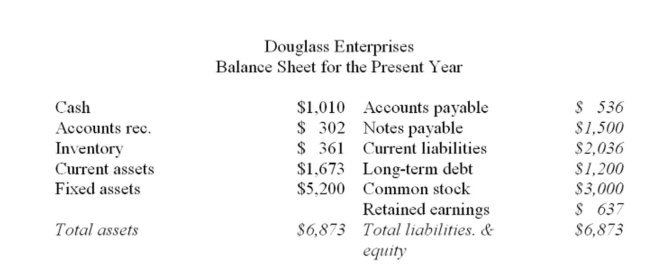

Assets, accounts payable and costs are proportional to sales. Debt and equity are not. The sales of Douglass Enterprises are expected to increase by 14% next year. The firm is currently

Assets, accounts payable and costs are proportional to sales. Debt and equity are not. The sales of Douglass Enterprises are expected to increase by 14% next year. The firm is currently

Producing at full capacity. Management wants to maintain a constant debt-equity ratio and a

Constant dividend payout ratio. What is the external financing need?

A) -$325

B) -$238

C) $542

D) $562

E) $962

Correct Answer:

Verified

Q124: Given the following information: assets = $900;

Q125: Q126: The following balance sheet and income statement Q127: Your company wants a sustainable growth rate Q128: The following balance sheet and income statement Q130: Shirley's Pastries expects sales of $253,000 next Q131: The following balance sheet and income statement Q132: For pro forma purposes, the Martin-Jones Company Q133: Guido's Garden Supplies has sales of $180,000, Q134: ![]()

![]()

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents