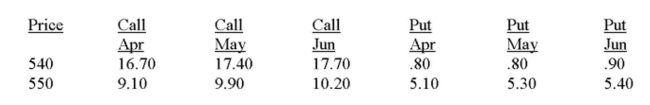

You own a small gold mine in Mexico. You expect to deliver 200 ounces of gold to the market in April. You decide to hedge your position at the 550 exercise price. How much will you receive in

Total, including the option premium, for your 200 ounces of gold if the market price of gold is $552

In April?

Gold - 100 troy oz.; $ per troy oz.

A) $108,180

B) $108,980

C) $109,380

D) $110,000

E) $111,820

Correct Answer:

Verified

Q65: For purposes of marking to market, what

Q66: What was the highest contract price that

Q67: You buy one futures contract for 5,000

Q68: How much will you pay to purchase

Q69: What is the difference in the total

Q71: You purchased two April futures contracts on

Q72: S&P 500 INDEX (CME); $500 times index

Q73: What was the lowest contract price at

Q75: You speculate in the market by selling

Q77: You sell one futures contract for 112,000

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents