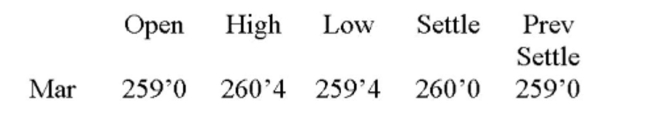

You are the purchasing agent for a cookie company. You anticipate that your firm will need 15,000 bushels of oats in March. You decide to hedge your position today and did so at the closing price of

The day. Assume that the actual market price turns out to be 261´0 on the day you actually buy the

Oats. How much more would you have spent or saved if you had not taken the hedge position?

Oats - 5,000 bu.: cents per bu.

A) Spent $15 more.

B) Spent $150 more.

C) Saved $15.

D) Saved $150.

E) Saved $1,500.

Correct Answer:

Verified

Q201: Hedging an asset with contracts written on

Q216: An option that gives the owner the

Q219: The financial risk known as transaction exposure

Q221: A forward contract on wheat:

A) Obligates the

Q223: If a firm creates an interest rate

Q225: A call option can best be defined

Q226: An agreement between two parties to exchange

Q227: If you can create a perfect hedge,

Q228: An option contract can best be defined

Q229: The buyer of a European put has

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents