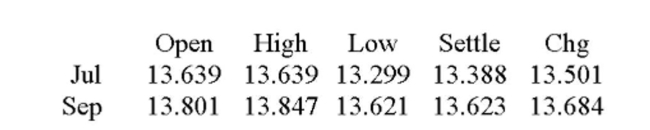

You are a jewelry maker. Every July you need to purchase 20,000 troy ounces of silver to cover your production needs. Today, you hedged your position at what turned out to be the lowest price

For the day. Assume the actual price per troy ounce of silver is 14.108 at time you need the silver in

July. How much more would you have spent or saved if you had not hedged your position?

Silver - 5,000 troy oz.: dollars and cents per troy oz.

A) Spent $16,180 more.

B) Spent $15,400 more.

C) Spent $9,740 more.

D) Saved $154, 00.

E) Saved $16,180.

Correct Answer:

Verified

Q255: Which of the following is NOT generally

Q256: A plot showing the gains and losses

Q257: Shin Bicycles makes reproduction cruisers just like

Q258: You are a jewelry maker. Every September

Q259: A firm has a risk profile that

Q261: A risk profile is a plot showing

Q262: The financial manager of AB Conners, Inc.

Q262: Explain the differences between hedging transactions exposure

Q263: Which one of the following actions would

Q265: An American call option is:

A) An obligation

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents