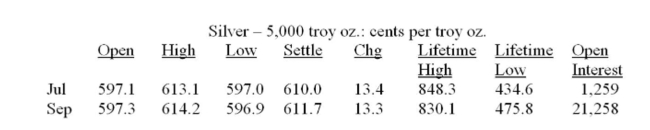

You are a jewelry maker. Every July you need to purchase 10,000 troy ounces of silver to cover your

production needs. Today you hedged your position at what turned out to be the lowest price for the

day. Assume that the actual price per troy ounce of silver is 605.0 at time you need the silver in

July. How much more would you have spent or saved if you had not hedged your position?

A) You saved $800.

B) You spent an extra $800.

C) You saved $8,000.

D) You spent an extra $8,000

E) You saved $80,000.

Correct Answer:

Verified

Q66: Explain why a swap is effectively a

Q265: You sold (wrote) a May American put

Q273: You sold (wrote) a May American call

Q275: Provide a suitable definition of risk profile.

Q276: If you have a _ rate loan

Q277: Provide a suitable definition of derivative security.

Q280: The Smith Co. can borrow money at

Q281: Provide a suitable definition of basis risk.

Q282: Provide a suitable definition of credit default

Q283: Provide a suitable definition of cross-hedging.

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents