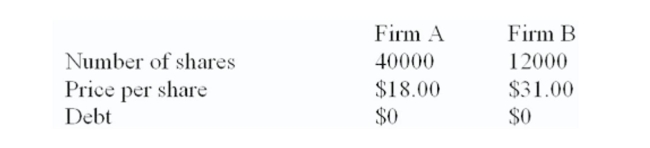

Firm B is willing to be acquired by firm A at a price of $34 a share in either cash or stock. The incremental value of the proposed acquisition is estimated at $80,000.  How many shares of stock will firm AB have if the merger is an all-stock deal?

How many shares of stock will firm AB have if the merger is an all-stock deal?

A) 52,000

B) 60,667

C) 62,333

D) 62,667

E) 63,333

Correct Answer:

Verified

Q141: Both firms are 100% equity-financed. Firm A

Q142: Babson Industrial has agreed to merge with

Q143: DEF stockholders are paid the current market

Q144: The Sligo Co. is planning on merging

Q145: Both firms are 100% equity-financed. Firm A

Q147: G&S Supply is being acquired by Deltona,

Q148: Watson's Office Supply has agreed to be

Q149: DEF stockholders are paid the current market

Q150: Holiday & Sons is being acquired by

Q151: Firm B is willing to be acquired

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents