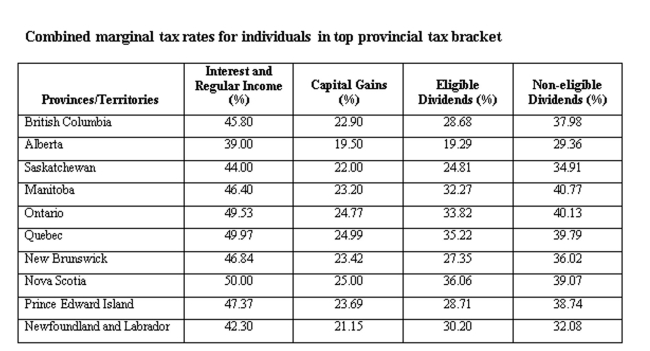

A Quebec resident earned $20,000 in interest income and $10,000 in capital gains. Calculate the total tax paid.

A) $8,493

B) $9,493

C) $10,493

D) $11,493

E) $12,493

Correct Answer:

Verified

Q17: If an asset has a carrying value

Q17: The financial statement summarizing a firm's performance

Q19: Non-cash items refer to expenses charged against

Q19: Conceptually, capital cost allowance (CCA) is equivalent

Q21: What is the operating cash flow for

Q23: What is the operating cash flow for

Q24: Marla's Homemade Cookies has net income of

Q25: If there are 100 shares of stock

Q26: Dale Corporation had beginning fixed assets of

Q27: If the firm has 180 million shares

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents