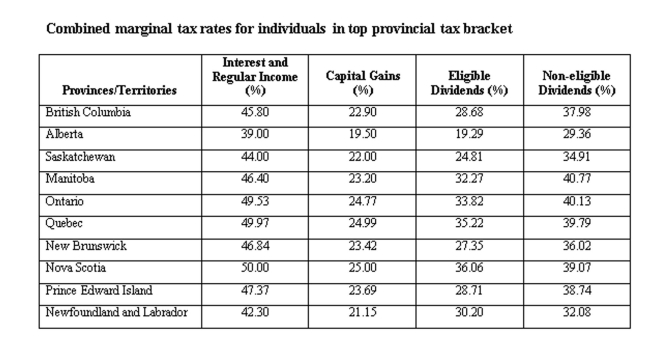

A Saskatchewan resident earned $30,000 in capital gains and $30,000 in non-eligible dividends. Calculate the total tax paid.

A) $17,073

B) $17,973

C) $18,073

D) $18,973

E) $19,073

Correct Answer:

Verified

Q56: The Row Boat Cafe has operating cash

Q57: A Prince Edward Island resident earned $20,000

Q58: Mylexhas current assets of $95, net fixed

Q59: What is the firm's cash flow to

Q60: What is the firm's net capital spending

Q62: What is the net new equity for

Q63: What is the operating cash flow for

Q64: If total assets = $550, fixed assets

Q65: Blaze Corporation had OCF of $400, change

Q66: A British Columbia resident earned $30,000 in

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents