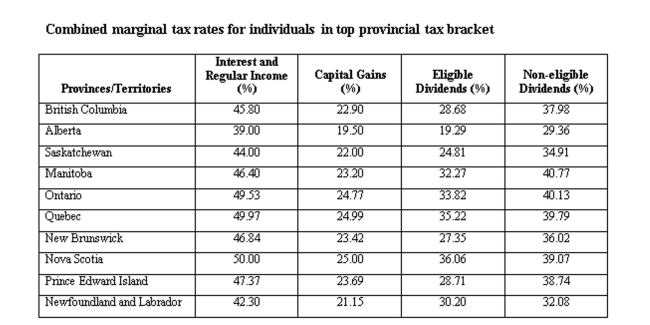

A Manitoba resident earned $30,000 in capital gains and $30,000 in non-eligible dividends. Calculate the total tax paid.

A) $17,191

B) $18,191

C) $19,191

D) $20,191

E) $21,191

Correct Answer:

Verified

Q71: What is the firm's cash flow to

Q72: At the beginning of the year, a

Q73: What is net new borrowing for 2015?

A)

Q74: What is the operating cash flow for

Q75: The cash flow to creditors for 2015

Q77: What is the firm's cash flow from

Q78: What is the net working capital for

Q79: If provincial tax rates are 16% on

Q80: Amy's Dress Shoppe has sales of $421,000

Q81: Brandy's Candies paid $23 million in dividends

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents