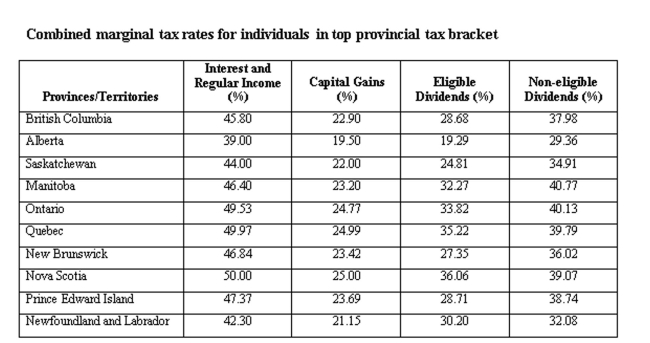

An Alberta resident earned $40,000 in interest income and $60,000 in eligible dividends. Calculate the average tax rate.

A) 29.13%

B) 28.98%

C) 27.17%

D) 26.90%

E) 26.20%

Correct Answer:

Verified

Q193: Which of the following are included in

Q194: Q195: An Albertaresident earned $30,000 in capital gains Q196: If provincial tax rates are 16% on Q198: A Manitobaresident earned $30,000 in capital gains Q200: An Ontarioresident earned $30,000 in capital gains Q201: Alpha, Inc. earned $95,000 in net income Q202: A Prince Edward Island resident earned $20,000 Q203: Which one of the following will increase Q204: If a company has taxable income =![]()

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents