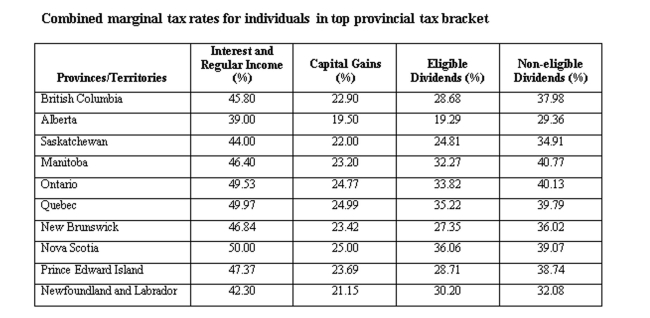

A Quebec resident earned $40,000 in interest income and $60,000 in eligible dividends. Calculate the average tax rate.

A) 41.12%

B) 42.12%

C) 43.12%

D) 44.12%

E) 45.12%

Correct Answer:

Verified

Q201: Alpha, Inc. earned $95,000 in net income

Q202: A Prince Edward Island resident earned $20,000

Q203: Which one of the following will increase

Q204: If a company has taxable income =

Q205: A firm has a calendar tax year.

Q207: An Ontario resident earned $40,000 in interest

Q208: Which one of the following will increase

Q209: If a firm has taxable income of

Q210: Determined the provincial marginal tax rate of

Q211: If a firm has taxable income of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents