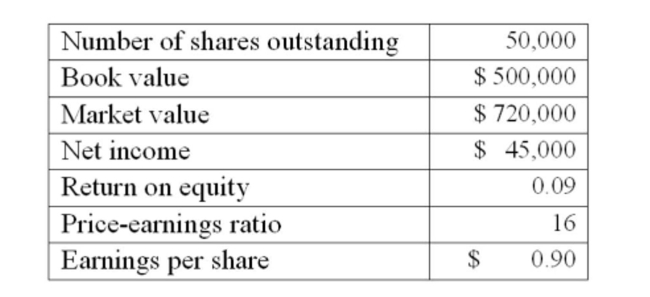

The Jenkins Co. is considering a project which requires the purchase of $315,000 of fixed assets. The net present value of the project is $20,000. Equity shares will be issued as the sole means of

financing the project. What will the new book value per share be after the project is implemented

Given the following current information on the firm?

A) $9.97

B) $10.88

C) $11.34

D) $13.15

E) $15.70

Correct Answer:

Verified

Q46: The value of a right granted by

Q49: In regards to the cost of issuing

Q60: The main difference between direct private long-term

Q61: The Green Hornet wants to raise $25

Q62: You decide to take your company public

Q64: Allied Corporation offers 40,000 shares of common

Q65: An Edmonton firm has 800,000 shares outstanding

Q66: You decide to raise $2 million in

Q67: Wagner Trucking is considering investing in a

Q68: A Windsor firm has 800,000 shares outstanding

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents