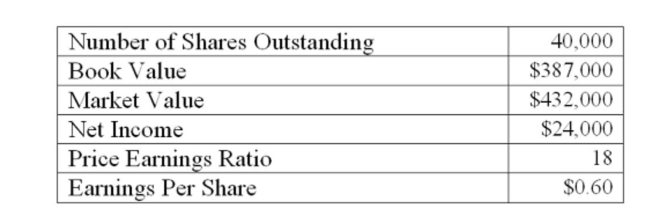

A Calgary firm is considering a new project which requires the purchase of $370,000 of new equipment. The net present value of the project is $67,000. The price-earnings ratio of the project

Equals that of the existing firm. What will the new market value per share be after the project is

Implemented given the following current information on the firm?

A) $11.70

B) $12.19

C) $12.49

D) $13.01

E) $13.13

Correct Answer:

Verified

Q70: TOYSrYOU needs to raise $5 million in

Q71: You decide to raise $8 million in

Q73: TOYSrYOU needs to raise $5 million in

Q75: The Jenkins Co. is considering a project

Q76: Frank Enterprises is sponsoring a rights offering

Q77: Assume that Classique decides to set the

Q77: Wexford Industries offers 60,000 shares of common

Q78: Glasses, Etc. is offering 100,000 shares of

Q79: The Purple Nickel is seeking to raise

Q80: Summit Health Care is sponsoring a rights

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents