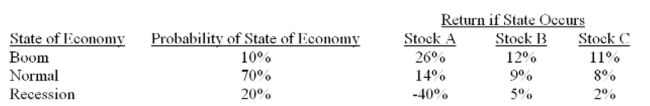

What is the standard deviation of a portfolio which is invested 10% in stock A, 35% in stock B and 55% in stock C?

A) 4.39%

B) 4.54%

C) 4.67%

D) 5.02%

E) 5.34%

Correct Answer:

Verified

Q83: Zelo,Inc. stock has a beta of 1.23.

Q184: You would like to combine a risky

Q185: An investor has purchased an auto stock.

Q186: The market has an expected rate of

Q187: What is the standard deviation of the

Q190: An investment firm is considering a portfolio

Q191: What is the expected return on a

Q192: The expected return on Justus, Inc. stock

Q192: What is the standard deviation of security

Q194: What is the standard deviation of a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents