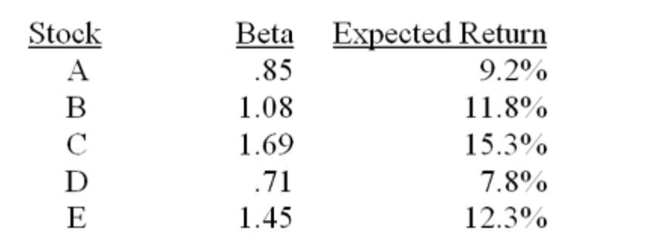

Which one of the following stocks is correctly priced if the risk-free rate of return is 3.6% and the market rate of return is 10.5%?

A) A

B) B

C) C

D) D

E) E

Correct Answer:

Verified

Q261: The true risk of any investment is

Q267: Suppose the Bank of Canada increased the

Q272: Ed Lawrence has $100,000 invested. Of that,

Q273: Which of the following is a correct

Q273: If the actual return on an investment

Q274: The primary purpose of portfolio diversification is

Q275: What concept does the following graph illustrate?

Q278: What matters to a diversified investor?

A) Systematic

Q279: Which of the following stocks is (are)

Q281: What relationship are the volatilities of stock

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents