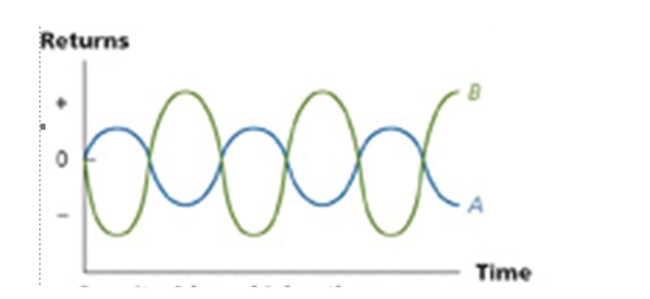

What relationship are the volatilities of stock A and B exhibiting?

A) Positive correlation.

B) Negative correlation

C) No correlation

D) Unsystematic correlation.

E) Systematic correlation.

Correct Answer:

Verified

Q282: When computing the expected return on a

Q285: An asset that has an expected rate

Q294: Which of the following is true about

Q294: Which of the following statements is false?

A)

Q296: The expected return on a portfolio:

A) Can

Q297: Which one of the following statements concerning

Q298: The steeper the slope of the security

Q299: When computing the expected return on a

Q300: Unsystematic risk:

A) Can be effectively eliminated through

Q305: Assume you are looking at a graph

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents