A project requires an initial fixed asset investment of $600,000, which will be depreciated straight- line to zero over the six-year life of the project. The pre-tax salvage value of the fixed assets at the

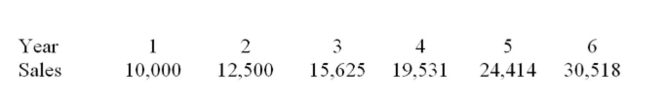

End of the project is estimated to be $50,001. Projected sales volume for each year of the project is

Shown below. The sale price is $50 per unit for the first three years, and $45 per unit for years 4

Through 1. A $30,000 initial investment in net working capital is required, with additional

Investments equal to 7.5% of annual sales for each year of the project. Variable costs are $35 per

Unit, and fixed costs are $50,000 per year. The firm has a tax rate of 34% and a required return on

Investment of 12%.  What is the NPV of the project?

What is the NPV of the project?

A) -$31,396

B) -$6,980

C) $86,980

D) $97,516

E) $133,255

Correct Answer:

Verified

Q210: You are considering investing in a piece

Q211: Kay's Nautique is considering a project which

Q212: You will bid to supply three jets

Q213: Dollar Diamond is considering a project which

Q214: A company has sales of $80,000, costs

Q216: Which of the following describes the "top-down"

Q217: The managers of PonchoParts, Inc. plan to

Q218: The depreciation tax shield is defined as:

A)

Q219: You are evaluating a project for The

Q220: Jackson & Sons uses packing machines to

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents