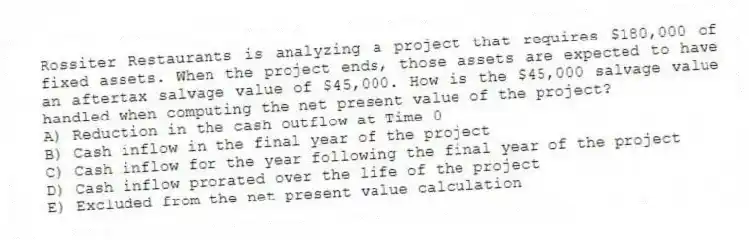

Rossiter Restaurants is analyzing a project that requires $180,000 of fixed assets. When the project ends, those assets are expected to have an aftertax salvage value of $45,000. How is the $45,000 salvage value handled when computing the net present value of the project?

A) Reduction in the cash outflow at Time 0

B) Cash inflow in the final year of the project

C) Cash inflow for the year following the final year of the project

D) Cash inflow prorated over the life of the project

E) Excluded from the net present value calculation

Correct Answer:

Verified

Q5: Samuelson Electronics has a required payback period

Q6: A project's average net income divided by

Q7: The length of time a firm must

Q8: Net present value:

A) is the best method

Q9: A project has an initial cost of

Q11: The length of time a firm must

Q12: A project has a net present value

Q13: Which of the following are advantages of

Q14: A project has a required payback period

Q15: Which one of the following methods of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents