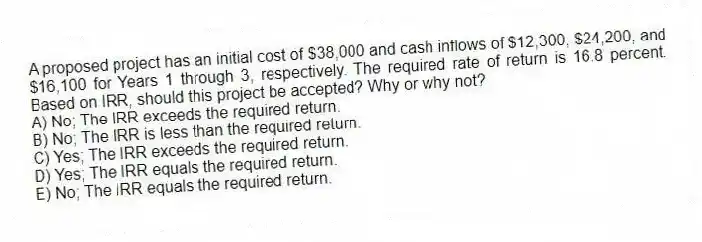

A proposed project has an initial cost of $38,000 and cash inflows of $12,300, $24,200, and $16,100 for Years 1 through 3, respectively. The required rate of return is 16.8 percent. Based on IRR, should this project be accepted? Why or why not?

A) No; The IRR exceeds the required return.

B) No; The IRR is less than the required return.

C) Yes; The IRR exceeds the required return.

D) Yes; The IRR equals the required return.

E) No; The IRR equals the required return.

Correct Answer:

Verified

Q79: A project has cash flows of -$108,000,

Q80: You are considering two mutually exclusive projects.

Q81: Projects A and B are mutually exclusive.

Q82: Colin is analyzing a 3-year project that

Q83: You are considering two mutually exclusive projects.

Q85: Crystal Industries is considering an expansion project

Q86: You are considering two independent projects. Project

Q87: An investment that provides annual cash flows

Q88: HH Companies has identified two mutually exclusive

Q89: Weston's uses straight-line depreciation to zero over

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents