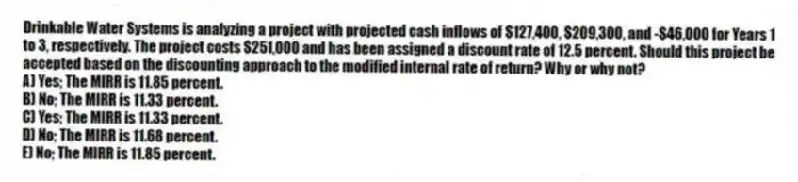

Drinkable Water Systems is analyzing a project with projected cash inflows of $127,400, $209,300, and -$46,000 for Years 1 to 3, respectively. The project costs $251,000 and has been assigned a discount rate of 12.5 percent. Should this project be accepted based on the discounting approach to the modified internal rate of return? Why or why not?

A) Yes; The MIRR is 11.85 percent.

B) No; The MIRR is 11.33 percent.

C) Yes; The MIRR is 11.33 percent.

D) No; The MIRR is 11.68 percent.

E) No; The MIRR is 11.85 percent.

Correct Answer:

Verified

Q93: An investment costs $152,000 and has projected

Q94: A project has cash flows of -$148,400,

Q95: Home & More is considering a project

Q96: A project has projected cash flows of

Q97: Projects A and B are mutually exclusive

Q99: A project has cash flows of -$152,000,

Q100: Project A has cash flows of −$50,000,

Q101: You estimate that a project will cost

Q102: Assume a project has cash flows of

Q103: Project A costs $47,800 with cash inflows

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents