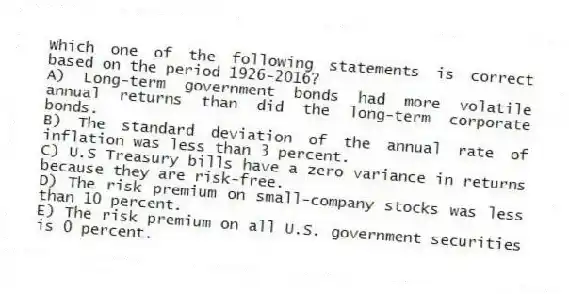

Which one of the following statements is correct based on the period 1926-2016?

A) Long-term government bonds had more volatile annual returns than did the long-term corporate bonds.

B) The standard deviation of the annual rate of inflation was less than 3 percent.

C) U.S Treasury bills have a zero variance in returns because they are risk-free.

D) The risk premium on small-company stocks was less than 10 percent.

E) The risk premium on all U.S. government securities is 0 percent.

Correct Answer:

Verified

Q32: Which one of the following is defined

Q33: Which one of the following is a

Q34: Assume you invest in a portfolio of

Q35: The return earned in an average year

Q36: To convince investors to accept greater volatility,

Q38: Which one of the following best defines

Q39: Which one of the following categories of

Q40: The average compound return earned per year

Q41: Which form of market efficiency would most

Q42: One year ago, you purchased a stock

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents