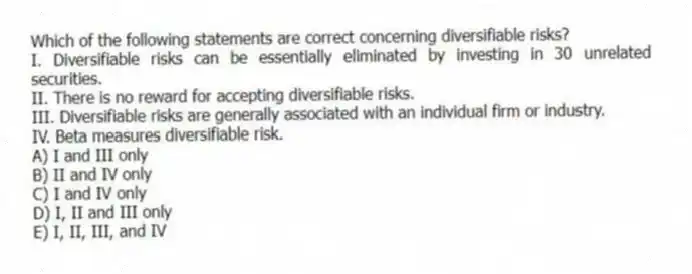

Which of the following statements are correct concerning diversifiable risks?

I. Diversifiable risks can be essentially eliminated by investing in 30 unrelated securities.

II. There is no reward for accepting diversifiable risks.

III. Diversifiable risks are generally associated with an individual firm or industry.

IV. Beta measures diversifiable risk.

A) I and III only

B) II and IV only

C) I and IV only

D) I, II and III only

E) I, II, III, and IV

Correct Answer:

Verified

Q31: Systematic risk is measured by:

A) the mean.

B)

Q32: Which one of the following statements is

Q33: A news flash just appeared that caused

Q34: Total risk is measured by _ and

Q35: The principle of diversification tells us that:

A)

Q37: The primary purpose of portfolio diversification is

Q38: The _ tells us that the expected

Q39: Which one of the following statements related

Q40: Which one of the following is the

Q41: The excess return earned by an asset

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents