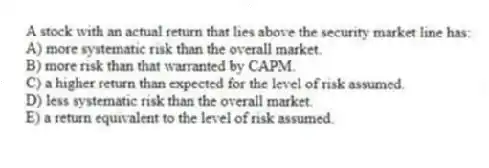

A stock with an actual return that lies above the security market line has:

A) more systematic risk than the overall market.

B) more risk than that warranted by CAPM.

C) a higher return than expected for the level of risk assumed.

D) less systematic risk than the overall market.

E) a return equivalent to the level of risk assumed.

Correct Answer:

Verified

Q47: The capital asset pricing model (CAPM) assumes

Q48: Which one of the following is represented

Q49: Which one of the following is the

Q50: Standard deviation measures which type of risk?

A)

Q51: Which one of the following will be

Q53: The market risk premium is computed by:

A)

Q54: The common stock of Manchester & Moore

Q55: Assume the market rate of return is

Q56: Which one of the following should earn

Q57: The reward-to-risk ratio for Stock A is

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents