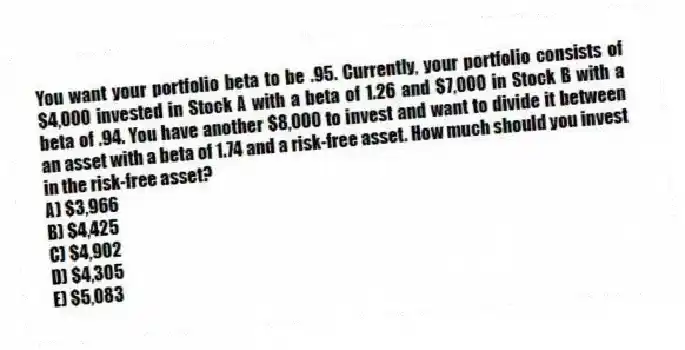

You want your portfolio beta to be .95. Currently, your portfolio consists of $4,000 invested in Stock A with a beta of 1.26 and $7,000 in Stock B with a beta of .94. You have another $8,000 to invest and want to divide it between an asset with a beta of 1.74 and a risk-free asset. How much should you invest in the risk-free asset?

A) $3,966

B) $4,425

C) $4,902

D) $4,305

E) $5,083

Correct Answer:

Verified

Q77: Your portfolio is invested 25 percent

Q78: You own a portfolio with the

Q79: What is the expected return on

Q80: What is the variance of the

Q81: The common stock of Jensen Shipping has

Q83: What is the standard deviation of

Q84: A stock has a beta of 1.17

Q85: Which one of the following stocks

Q86: You have a $15,000 portfolio which is

Q87: The expected return on JK stock is

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents