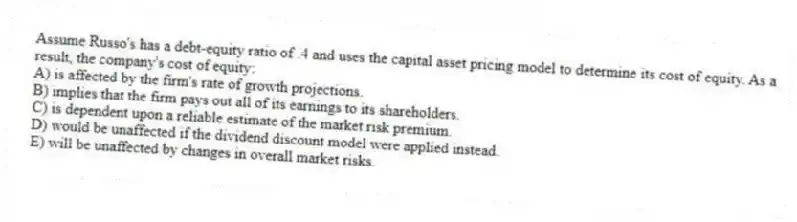

Assume Russo's has a debt-equity ratio of .4 and uses the capital asset pricing model to determine its cost of equity. As a result, the company's cost of equity:

A) is affected by the firm's rate of growth projections.

B) implies that the firm pays out all of its earnings to its shareholders.

C) is dependent upon a reliable estimate of the market risk premium.

D) would be unaffected if the dividend discount model were applied instead.

E) will be unaffected by changes in overall market risks.

Correct Answer:

Verified

Q1: A company's current cost of capital is

Q3: A company's overall cost of equity is:

A)

Q4: A company's weighted average cost of capital:

A)

Q5: All else constant, which one of the

Q6: The capital asset pricing model approach to

Q7: The cost of preferred stock:

A) is equal

Q8: The cost of preferred stock is computed

Q9: Which one of the following is the

Q10: Black River Tours has a capital structure

Q11: A group of individuals got together and

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents