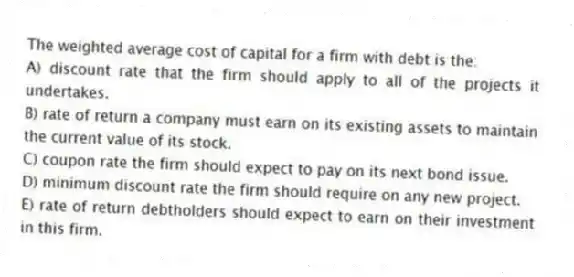

The weighted average cost of capital for a firm with debt is the:

A) discount rate that the firm should apply to all of the projects it undertakes.

B) rate of return a company must earn on its existing assets to maintain the current value of its stock.

C) coupon rate the firm should expect to pay on its next bond issue.

D) minimum discount rate the firm should require on any new project.

E) rate of return debtholders should expect to earn on their investment in this firm.

Correct Answer:

Verified

Q34: Incorporating flotation costs into the analysis of

Q35: Flotation costs for a levered firm should

Q36: The subjective approach to project analysis:

A) is

Q37: If a company uses its WACC as

Q38: The Road Stop is a national hotel

Q40: Assigning discount rates to individual projects based

Q41: National Home Rentals has a beta of

Q42: Handy Man, Inc., has zero coupon bonds

Q43: Stock in Country Road Industries has a

Q44: The common stock of Metal Molds has

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents