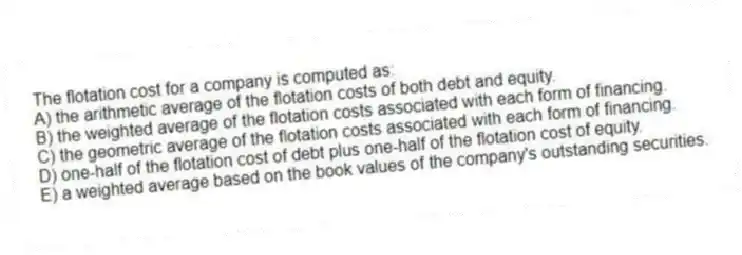

The flotation cost for a company is computed as:

A) the arithmetic average of the flotation costs of both debt and equity.

B) the weighted average of the flotation costs associated with each form of financing.

C) the geometric average of the flotation costs associated with each form of financing.

D) one-half of the flotation cost of debt plus one-half of the flotation cost of equity.

E) a weighted average based on the book values of the company's outstanding securities.

Correct Answer:

Verified

Q23: Why does the tax amount need to

Q24: The average of a company's cost of

Q25: The discount rate assigned to an individual

Q26: When a manager develops a cost of

Q27: When a firm has flotation costs equal

Q29: Which one of the following statements is

Q30: Jenner's is a multi-division firm that uses

Q31: Which one of the following statements is

Q32: The weighted average cost of capital for

Q33: Which one of the following statements related

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents