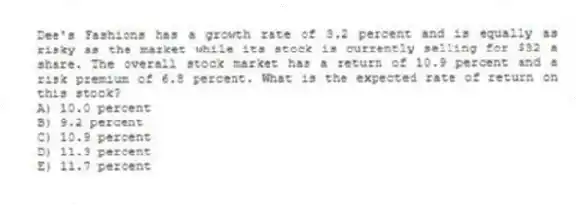

Dee's Fashions has a growth rate of 3.2 percent and is equally as risky as the market while its stock is currently selling for $32 a share. The overall stock market has a return of 10.9 percent and a risk premium of 6.8 percent. What is the expected rate of return on this stock?

A) 10.0 percent

B) 9.2 percent

C) 10.9 percent

D) 11.3 percent

E) 11.7 percent

Correct Answer:

Verified

Q43: Stock in Country Road Industries has a

Q44: The common stock of Metal Molds has

Q45: Holdup Bank has an issue of preferred

Q46: The Shoe Outlet has paid annual dividends

Q47: Tidewater Fishing has a current beta of

Q49: Fashion Wear has bonds outstanding that mature

Q50: Street Corporation's common stock has a beta

Q51: The Pet Market has $1,000 face value

Q52: Jay's Bakery has a bond issue outstanding

Q53: Hydro Systems has bonds outstanding with a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents