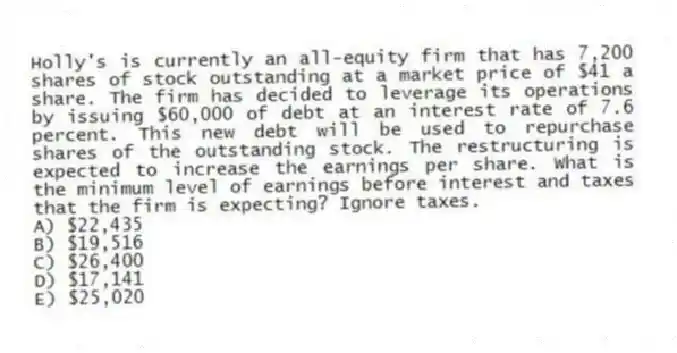

Holly's is currently an all-equity firm that has 7,200 shares of stock outstanding at a market price of $41 a share. The firm has decided to leverage its operations by issuing $60,000 of debt at an interest rate of 7.6 percent. This new debt will be used to repurchase shares of the outstanding stock. The restructuring is expected to increase the earnings per share. What is the minimum level of earnings before interest and taxes that the firm is expecting? Ignore taxes.

A) $22,435

B) $19,516

C) $26,400

D) $17,141

E) $25,020

Correct Answer:

Verified

Q42: Paradise Travels is an all-equity firm that

Q43: Naylor's is an all-equity firm with 48,000

Q44: Which one of these statements related to

Q45: Miller's Dry Goods is an all-equity firm

Q46: Theo currently owns 700 shares of JKL,

Q48: Under the Bankruptcy Abuse Prevention and Consumer

Q49: The absolute priority rule determines:

A) when a

Q50: In general, the capital structures of U.S.

Q51: With the exception of a few industries,

Q52: A company is technically insolvent when:

A) it

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents