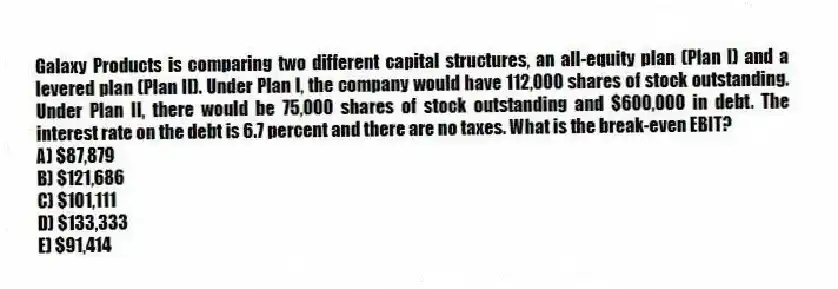

Galaxy Products is comparing two different capital structures, an all-equity plan (Plan I) and a levered plan (Plan II) . Under Plan I, the company would have 112,000 shares of stock outstanding. Under Plan II, there would be 75,000 shares of stock outstanding and $600,000 in debt. The interest rate on the debt is 6.7 percent and there are no taxes. What is the break-even EBIT?

A) $87,879

B) $121,686

C) $101,111

D) $133,333

E) $91,414

Correct Answer:

Verified

Q74: Eastern Markets has no debt outstanding and

Q75: Lamont Corp. is debt-free and has a

Q76: Winter's Toyland has a debt-equity ratio of

Q77: Noelle owns 12 percent of The Toy

Q78: North Side Inc. has no debt outstanding

Q80: The Corner Bakery has a debt-equity ratio

Q81: Wholesale Supply has earnings before interest and

Q82: New Schools is an all-equity company with

Q83: LP Gas has a cost of equity

Q84: Home Decor has a debt-equity ratio of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents