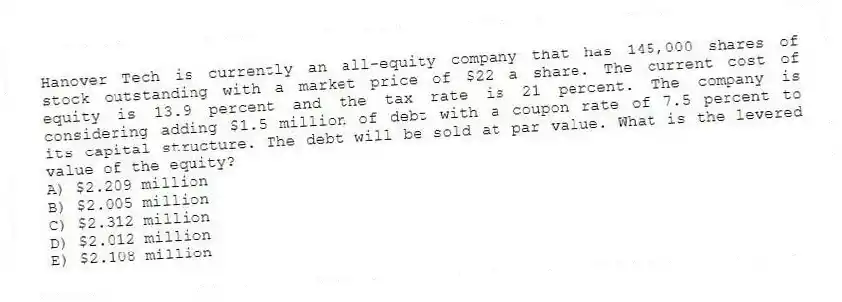

Hanover Tech is currently an all-equity company that has 145,000 shares of stock outstanding with a market price of $22 a share. The current cost of equity is 13.9 percent and the tax rate is 21 percent. The company is considering adding $1.5 million of debt with a coupon rate of 7.5 percent to its capital structure. The debt will be sold at par value. What is the levered value of the equity?

A) $2.209 million

B) $2.005 million

C) $2.312 million

D) $2.012 million

E) $2.108 million

Correct Answer:

Verified

Q68: An unlevered company has a cost of

Q69: Lamey Co. has an unlevered cost of

Q70: Roy's Welding has a cost of equity

Q71: L.A. Clothing has expected earnings before interest

Q72: Key Motors has a cost of equity

Q74: Eastern Markets has no debt outstanding and

Q75: Lamont Corp. is debt-free and has a

Q76: Winter's Toyland has a debt-equity ratio of

Q77: Noelle owns 12 percent of The Toy

Q78: North Side Inc. has no debt outstanding

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents